Tax Credits

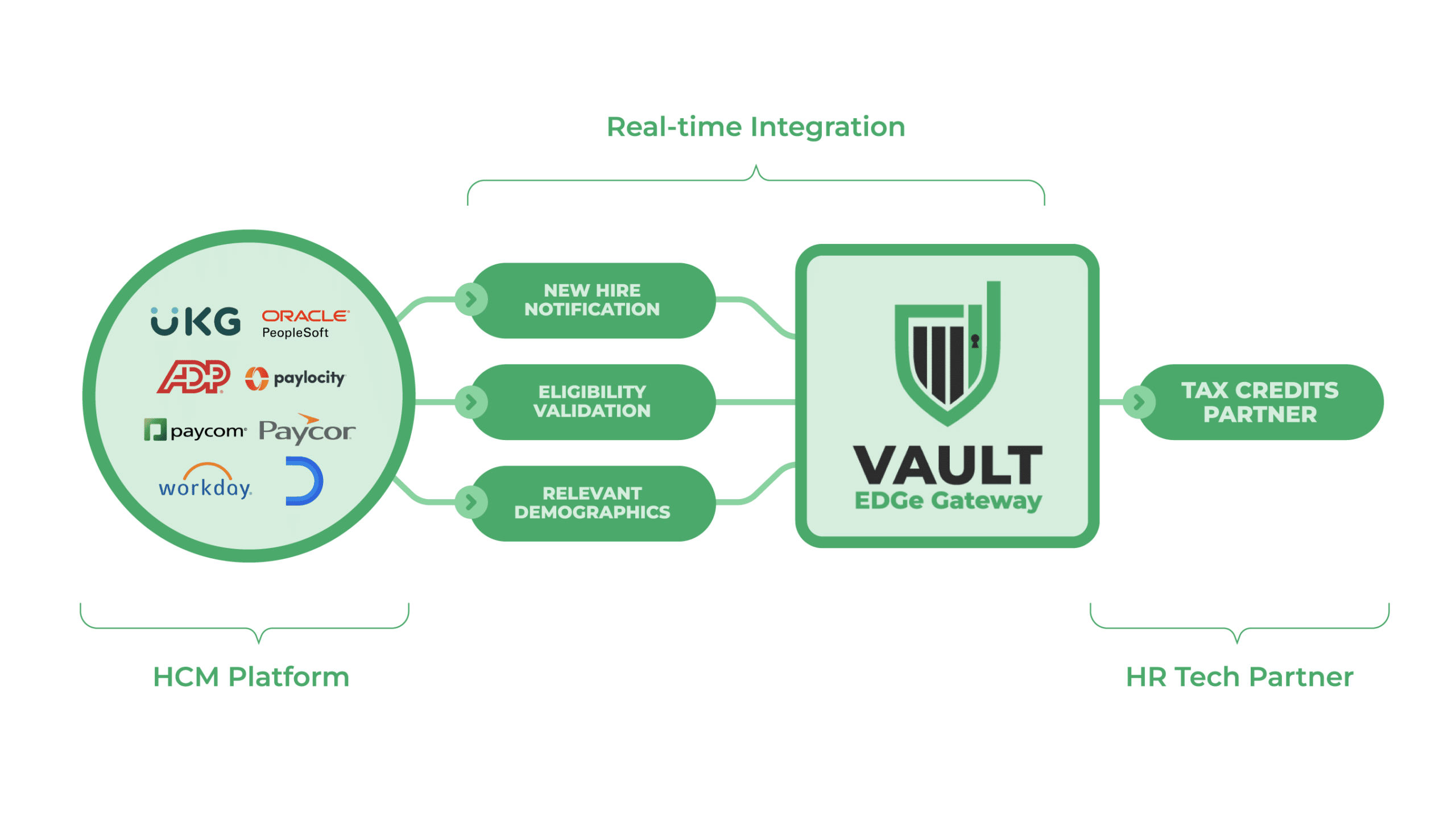

Using Vault Verify’s Vault EDGe Gateway, tax credit partners can provide a seamless data integration to manage business tax credits. By leveraging our powerful data integration tool, our partner providers can securely gather the required data elements to determine your company’s eligibility to save significant sums on state and/or federal taxes without any additional HR integrations.

Tax credit services stand ready to do all the hard work of dealing with the government forms and payroll compliance on your behalf.

Why Choose A Vault Verify Partner for Tax Credits?

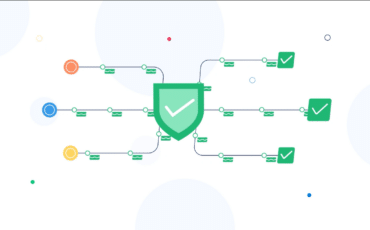

Vault Verify manages the exclusive, industry-leading data solution to streamline and protect your tax credit partner’s assessment.

The Vault EDGe Gateway is a secure real-time API that Vault Verify establishes with your HCM platform. This exclusive employee data gateway is a solution that empowers sanctioned HR tech service providers, including selected tax credit management consultants, to access key data and receive event-triggered alerts.

With this enhanced capability, the HR labor burden to support tax credit assessment is reduced, while your data remains secure. Only the data elements needed for the tax credit service are accessed in real time, reducing exposure risk and increasing accuracy and timeliness.

One integration, the Vault EDGe Gateway, can serve the needs of many qualified service providers within your ideal HR tech stack.

PLUS…Let Us Show You How to Save on Tax Credits Administration Fees!

Schedule a Demo

In just 30 minutes, we’ll show you how the Vault EDGe Gateway empowers our

Tax Credits partners to find your company substantial tax savings while

saving you time and money!